#Bookkeeping for small business free

This Free general ledger is a crucial component of your business because it assists in keeping your business running smoothly and making sure that all financial accounting details are correct. The accounts receivable ledger lets you manage the outstanding balances owed by customers, so you can streamline the process of collection efforts.

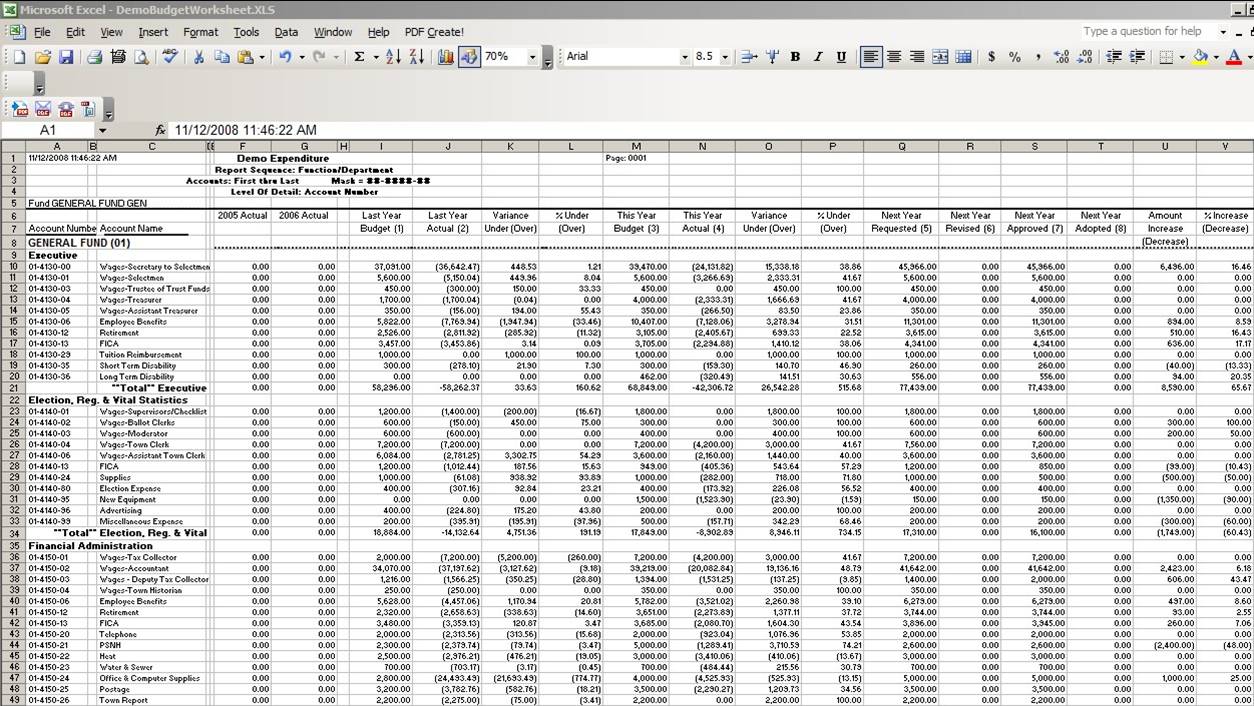

With this worksheet, you will be able to see all income streams and take note of all costs incurred in the course of doing business. This simple income and expense worksheet lets you track your money. Small Business Income & Expenses Template

#Bookkeeping for small business trial

The ready to use trial balance excel templates enables you to prepare the statement of all closing balances of ledger accounts on a particular date. The statement of accounts template lets you provide a record of client’s purchases and payments, along with the automatically calculated running balance. It allows you to enter transactions, and see financial reports based on these transactions. It can be used to track income, expenses, and your bank balance. This bookkeeping template is a simple, more straightforward approach to bookkeeping. We put together the 20 best bookkeeping templates and Excel spreadsheets, here they are: Fail to keep track of receipts, and you miss out on all kinds of business-tax deductions. Lose track of your invoices coming in, and you’ll lose money.Do you need a better way to track your expenses, accounting, and stay on top of bookkeeping for your small business?

Like it or not, the state of your business books may very well determine whether your business lives or dies. Forget to pay a bill, and there goes your credit. It can be a real pain for small-business owners in particular, who are more likely to be handling these tasks on their own. Payroll is an increasingly complex task, with unemployment tax rates changing all the time, state and local taxes to contend with, and tax-filing deadlines to remember. If you mess up your federal payroll taxes, you will be hearing from the government. The survey didn't mention payroll, which tends to complicate matters for small-business owners. Related: Passion Alone Is Not Enough to Open a Business With bookkeeping, it's easy to make mistakes, and mistakes can be costly.Bookkeeping can be very time-consuming (especially if you're new at it.).When you see your business expenses racking up and little income trickling in, it can hurt. It's all about cold hard facts - the truth. Unless you have an accounting degree, you won’t automatically know the first thing about basic accounting practices. The survey didn't delve into the reasons why bookkeeping tasks gets no love, but I can fill in some of the blanks from past experience. Handling finances, banking and marketing were also unpopular items on the to-do list of many small-business owners. And the more time the business owners spent running their businesses, the more they loathed the task - 58 percent of business owners working 60 or more hours a week said that bookkeeping was particularly draining. Almost half of the owners surveyed said that bookkeeping was their least favorite task.

0 kommentar(er)

0 kommentar(er)